Who should file an Income Tax Return (ITR)?

The persons who are mandatorily required to file their Return of Income have been specified under section 139(1) of the Income Tax Act, 1961.

Let’s understand this in a summarized manner-

The section specifies that Every Person who is:

(a) A Company or Firm; or

(b) A person other than a Company or a Firm, if his total income during the previous year exceeded the maximum amount which is not chargeable to income tax,

is required to furnish a return of his income on or before the due date.

We need to understand the following terms-

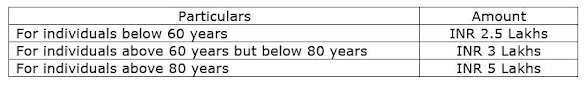

1) Maximum Amount not chargeable to income tax:

2) Due date for furnishing Return of Income:

In order to ensure that persons who enter into certain high-value transactions do furnish their return of income-

Section 139 of the Income Tax Act, 1961 is amended so as to provide that a person shall be mandatorily required to file his return of income if, during the previous year, such a person had undertaken any of such high-value transactions.

The seventh proviso to section 139(1) has been inserted vide Finance Act, 2019. This is applicable only to a person other than a company or a firm.

According to this proviso, the following persons shall also be required to furnish their return of income mandatorily-

- Who has deposited an amount or aggregate of the amounts exceeding INR 1 Crore in one or more current accounts maintained with a banking company or a co-operative bank; or

- Who has incurred expenditure of an amount or aggregate of the amounts exceeding INR 2 Lakh for himself or any other person for travel to a foreign country; or

- Who has incurred expenditure of an amount or aggregate of the amounts exceeding INR 1 Lakh towards consumption of electricity; or

- Who fulfils such other conditions as may be prescribed.

CBDT vide Notification No. 37/2022 dated 21.04.2022 has notified additional four conditions for furnishing a return of income in terms of clause (iv) of the seventh proviso to section 139(1) of Income-tax Act, 1961 and inserted a new Rule 12AB in the Income-tax Rules, 1962-

- If his total sales, turnover or gross receipts, as the case may be, in the business exceeds INR 60 Lakh during the previous year; or

- If his total gross receipts in profession exceed INR 10 Lakh during the previous year; or

- If the aggregate amount of TDS and TCS during the previous year is INR 25,000 or more (for a senior citizen, the limit is INR 50,000); or

- If the aggregate amount of deposit in one or more savings bank accounts of the person is INR 50 Lakh or more during the previous year.

An Ordinarily Resident shall be mandatorily required to file ITR on or before the due date-

If any time during the previous year,

– holds, as a beneficial owner or otherwise, any asset (including any financial interest in any entity) located outside India or has signing authority in any account located outside India; or

– is a beneficiary of any asset (including any financial interest in any entity) located outside India.

If the taxpayer is a company or a firm, it is required to file ITR mandatorily irrespective of profit or loss.

Why is it required to file ITR?

- It is a statutory obligation to furnish the return of income if their gross income is more than the basic exemption limit.

- It will be helpful for availing of a loan or getting a credit card easily.

- It will smoothen your visa process while travelling overseas.

- It helps to carry forward your capital losses for the next 8 consecutive financial years.

What will happen if ITR is not filed on time?

- A taxpayer will be liable to pay a penalty interest of 1% per month on the amount of unpaid tax under section 234A of the Income Tax Act.

- A late filing fee will be applicable for filing returns after the due date under Section 234F. This fee could go up to INR 10,000.

- The returns will be processed late and the refund of excess tax paid will become late.

—

Hemanth Uppala

CA Finalist

Content Writer | TAX DESTINATION